What is the National Mortgage Guarantee (NHG)?

The National Mortgage Guarantee (NHG) protects both homeowners and lenders in the Netherlands.

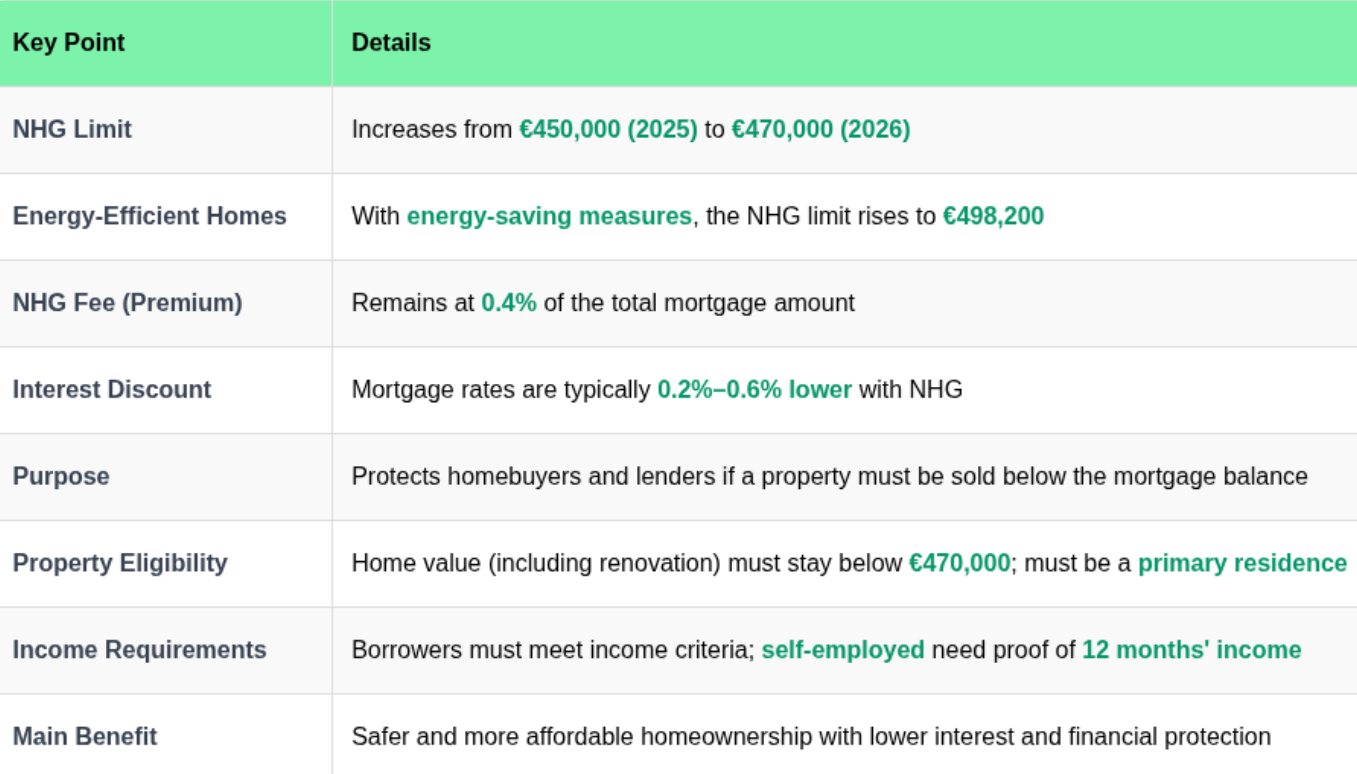

If you have to sell your home and the sale price is not enough to cover your mortgage, NHG can help pay off the rest. This protection prevents serious financial hardship for homeowners and reduces lenders' risk.

The NHG is especially popular among first-time buyers who want extra financial security when purchasing their home.

NHG limit in 2026

The NHG limit changes each year to reflect the average housing prices in the Netherlands. By changing the limit every year, more buyers can benefit from the NHG’s financial protection. This is especially helpful for first-time buyers.

In 2026, the NHG limit will rise from €450,000 (in 2025) to €470,000.

This means that if your total mortgage amount, including renovation costs, is within this limit, you can get an NHG-backed mortgage.

NHG for energy-efficient homes

To support sustainability, NHG offers additional borrowing capacity for homes that include energy-saving upgrades.

From 2026, the NHG limit for energy-efficient homes will rise to €498,200.

This applies to all types of property. It encourages investment in features like insulation, solar panels, and energy-efficient heating systems.

The goal is clear: make homeownership safe and sustainable. We want to protect homeowners from financial troubles. This includes issues like job loss, illness, or divorce.

NHG interest discount

Many lenders offer lower interest rates on NHG mortgages. Because NHG lowers lenders' financial risk, borrowers can often get a discount of up to 0.6% on standard mortgage rates.

Our happy clients

We focus on delivering great results — and our clients' feedback tells the rest of the story.